Collab Fund

As a prominent capital source for forward-thinking entrepreneurs, Collab Fund encourages innovation that paves the way for a better world.

Thirty-seven thousand Americans died in car accidents in 1955, six times today’s rate adjusted for miles driven.

Ford began offering seat belts in every model that year. It was a $27 upgrade, equivalent to about $190 today. Research showed they reduced traffic fatalities by nearly 70%.

But only 2% of customers opted for the upgrade. Ninety-eight percent of buyers preferred to remain at the mercy of inertia.

Things eventually changed, but it took decades. Seatbelt usage was still under 15% in the early 1980s. It didn’t exceed 80% until the early 2000s – almost half a century after Ford offered them in all cars.

It’s easy to underestimate how social norms stall change, even when the change is an obvious improvement. One of the strongest forces in the world is the urge to keep doing things as you’ve always done them, because people don’t like to be told they’ve been doing things wrong. Change eventually comes, but agonizingly slower than you might assume.

Dunkirk was a miracle. More than 330,000 Allied soldiers, pinned down by Nazi attacks, were successfully evacuated from the beaches of France back to England, ferried by hundreds of small civilian boats.

London broke out in celebration when the mission was completed. Few were more relieved than Winston Churchill, who feared the imminent destruction of his army.

But Edmund Ironside, commander of British Home Forces, pointed out that if the Allies could quickly ferry a third of a million troops from France to England while avoiding aerial attack, the Germans probably could, too. Churchill had been holding onto hope that Germany couldn’t cross the Channel with an invasion force; such a daring mission seemed impossible. But then his own army proved it was quite possible. Dunkirk was both a success and a foreboding.

Your competitors can probably innovate and execute as well as you can. So every time you uncover a new talent you’re proud of, temper your thrill with the acceptance that other people who want to win as badly as you probably aren’t far behind.

Notorious BIG once casually mentioned that he began selling crack in fourth grade. He explained:

They [teachers] was always like, “Take the talent that you have and think of something that you can do in the future with it.”

And I was like, “Well, I like to draw.” So what could I do with drawing? What am I gonna be, an art dealer? I’m not gonna be that type. I was thinking maybe I can do big billboards and shit. Like commercial art.

And then after that I got introduced to crack. Haha, now I’m thinking, commercial art?! Haha. I’m out here for 20 minutes and I can make some real, real money, man.

Incentives drive everything, and most of us underestimate what we’d be willing to do if the incentives were right.

When Barack Obama discussed running for president in 2005, his friend George Haywood – an accomplished investor – gave him a warning: the housing market was about to collapse, and would take the economy down with it.

George told Obama how mortgage-backed securities worked, how they were being rated all wrong, how much risk was piling up, and how inevitable its collapse was. And it wasn’t just talk: George was short the mortgage market.

Home prices kept rising for two years. By 2007, when cracks began showing, Obama checked in with George. Surely his bet was now paying off?

Obama wrote in his memoir:

George told me that he had been forced to abandon his short position after taking heavy losses.

“I just don’t have enough cash to stay with the bet,” he said calmly enough, adding, “Apparently I’ve underestimated how willing people are to maintain a charade.”

Irrational trends rarely follow rational timelines. Unsustainable things can last longer than you think.

When the Black Death plague entered England in 1348, the Scots up north laughed at their good fortune. With the English crippled by disease, now was a perfect time for Scotland to stage an attack on its neighbor.

The Scots huddled together thousands of troops in preparation for battle. Which, of course, is the worst possible move during a pandemic.

“Before they could move, the savage mortality fell upon them too, scattering some in death and the rest in panic,” historian Barbara Tuchman writes in her book A Distant Mirror.

There’s a powerful urge to think risk is something that happens to other people. Other people get unlucky, other people make dumb decisions, other people get swayed by the seduction of greed and fear. But you? Me? No, never us. False confidence makes the eventual reality all the more shocking.

Some are more susceptible to risk than others, but no one is exempt from being humbled.

Dr. Dan Goodman once performed surgery on a middle-aged woman whose cataract had left her blind since childhood. The cataract was removed, leaving the woman with near-perfect vision. A miraculous success.

The patient returned for a checkup a few weeks later. The book Crashing Through writes:

Her reaction startled Goodman. She had been happy and content as a blind person. Now sighted, she became anxious and depressed. She told him that she had spent her adult life on welfare and had never worked, married, or ventured far from home – a small existence to which she had become comfortably accustomed. Now, however, government officials told her that she no longer qualified for disability, and they expected her to get a job. Society wanted her to function normally. It was, she told Goldman, too much to handle.

Every goal you dream about has a downside that’s easy to overlook.

Historian John Meecham writes:

When we condemn [the past] for slavery, or for Native American removal, or for denying women their full role in the life of the nation, we ought to pause and think: What injustices are we perpetuating even now that will one day face the harshest of verdicts by those who come after us?

This applies to so many things.

What is the modern version of cigarettes, which were doctor-recommended just a few generations ago? We didn’t know dinosaurs existed 200 years ago, which makes you wonder what else is out there that we’re oblivious to today. What company is the modern Enron, so obviously a fraud? What do most people – not a few wackos, but most of us – believe that will look something between hilarious and disgraceful 100 years from now?

A lot of history is just gawking at how wrong, how blind, people can be. Disastrously wrong, embarrassingly blind. Millions of people, all at the same time. When you then realize that today will be considered history in a few generations … oh dear. It’s unpleasant. But also fascinating.

Apollo 11 was the first time in history humans visited another celestial body.

You’d think that would be an overwhelming experience – literally the coolest thing any human had ever done. But as the spacecraft hovered over the moon, Michael Collins turned to Neil Armstrong and Buzz Aldrin and said:

It’s amazing how quickly you adapt. It doesn’t seem weird at all to me to look out there and see the moon going by, you know?

Three months later, after Al Bean walked on the moon during Apollo 12, he turned to astronaut Pete Conrad and said “It’s kind of like the song: Is that all there is?” Conrad was relieved, because he secretly felt the same, describing his moonwalk as spectacular but not momentous.

Most mental upside comes from the thrill of anticipation – actual experiences tend to fall flat, and your mind quickly moves on to anticipating the next event. That’s how dopamine works.

If walking on the moon left astronauts underwhelmed, what does it say about our own earthly goals and expectations?

John Nash is one of the smartest mathematicians to ever live, winning the Nobel Prize. He was also schizophrenic, and spent most of his life convinced that aliens were sending him coded messages.

In her book A Beautiful Mind, Silvia Nasar recounts a conversation between Nash and Harvard professor George Mackey:

“How could you, a mathematician, a man devoted to reason and logical proof, how could you believe that extraterrestrials are sending you messages? How could you believe that you are being recruited by aliens from outer space to save the world?” Mackey asked.

“Because,” Nash said slowly in his soft, reasonable southern drawl, “the ideas I had about supernatural beings came to me the same way that my mathematical ideas did. So I took them seriously.”

This is a good example of a theory I have about very talented people: No one should be shocked when people who think about the world in unique ways you like also think about the world in unique ways you don’t like. Unique minds have to be accepted as a full package.

More:

Below is a transcript from a recent podcast I did on the tariff news.

My business that I use for my books and my speaking and whatnot is called Long Term Words, LLC. Now, the name of that is not very important. Nobody sees it unless I’m doing a talk with you or something. But let me tell you the origin behind that name, why I picked that name, because it’s relevant to today’s episode.

I’ve always wanted at least the opportunity that anything I write in a book or an article, that it has at least a fighting chance to still be relevant, 10, 20, even 50 years from now. I only want to write about things that are timeless because I’ve never enjoyed, as a reader, reading news that has an expiration date on it.

If this news article is not going to be relevant a year from now, it shouldn’t be relevant to me today. That’s always been my philosophy, and I’ve wanted to do that with my own writing. Write things that at least have a fighting chance for somebody to read and enjoy and maybe learn from many decades into the future.

That’s always been the goal. Long term words. I bring that up because today’s episode is going to be a rare departure from that in which I’m gonna talk about something that is happening in the news today and this week, and that is tariffs and the market reaction to it. We’ll get in that as well. So if that’s not your thing, if you’re only interested in the long term words, this episode might not be for you.

So before I jump into my detailed thoughts about what I think is going on, let me put my cards on the table. I think the tariffs are a terrible idea. Not just a terrible idea, but a horrendous idea.

Now I understand that all of us, everybody, including me, everybody can live in their own bubble. Particularly for these topics where it’s very hard to divorce economics and money from politics. So if you disagree with that broad view and you think the tariffs are a good idea, let me just state I respect you. I’d love to hear you. Everyone sees the world through their own unique lens, and it’s naive to assume that my lens is clearer than yours, even if it might be different.

Look, I’m a free market person. Of course. I understand the need for law and regulation and even tariffs in certain situations like masks during covid when we are reliant on other countries for things that we desperately needed, or military supplies, you don’t wanna re reliant on other countries making your military supplies in a war.

So tariffs can absolutely have their function in a well-run economy. But this what’s going on in the last week seems completely backwards, I think, to everything that we know and have learned about economics. Let me give you one analogy that’s been helpful to me with this. For nutrition science in terms of what kind of diet should you eat, what is the best diet that you and I can eat to live the healthiest life?

Nutritionists and health experts fiercely disagree on what the best diet you should eat. Should it be keto, should you be vegan? Everything in between. There’s so many different nuanced views over nutrition. But everybody agrees that eating lots of refined sugar is bad. There’s no disagreement about that. If you’re eating lots and lots of processed, refined sugar, that’s not good for you, even if there’s so much disagreement about everything else, and I think that is how economics works as well. There is so much disagreement. Among economists and politicians and investors over how to run the economy, what’s the right level of taxation?

Should it be more, should it be less? What’s the right level of regulation? Fierce disagreements among very smart people, but tariffs are the equivalent of refined sugar. You’ll be very hard pressed to find many economists. Of course, there’s always going to be one or two standouts here or there that make a lot of noise.

But one of the most agreed upon topics in economics is that tariffs are bad and trade wars are destructive. And the broad reason why is because tariffs by and large do two things. They raise prices for consumers and they make manufacturers back at home less competitive.

And one good way to explain this, I think that’s been helpful for my thinking, is just understanding the value of specialization of trade.

Now, I am a writer. I might have some skills at writing. I do not have any skills whatsoever at plumbing or electricity.

So when I need those things resolved, I hire a plumber, I hire an electrician because they are much better at those tasks than I am in that situation. When I hire a plumber, the plumber is not taking advantage of me. Even though I have a trade deficit with him, because he’s probably not buying my books, but I’m buying his services.

I have a trade deficit with the plumber. Nobody is being taken advantage of in that situation. He has a skill that I don’t, I can exchange my money for his skills. Everybody is better off. He’s better off. I’m better off.

Most people can understand that at the individual level. And that is also true at the economic level. There are some skills that the United States has that we are ridiculously good and talented at. There are other things that other nations are much better than us. And there’s no shame in that, just in the same way that I am not shamed at the fact that I’m not good at plumbing.

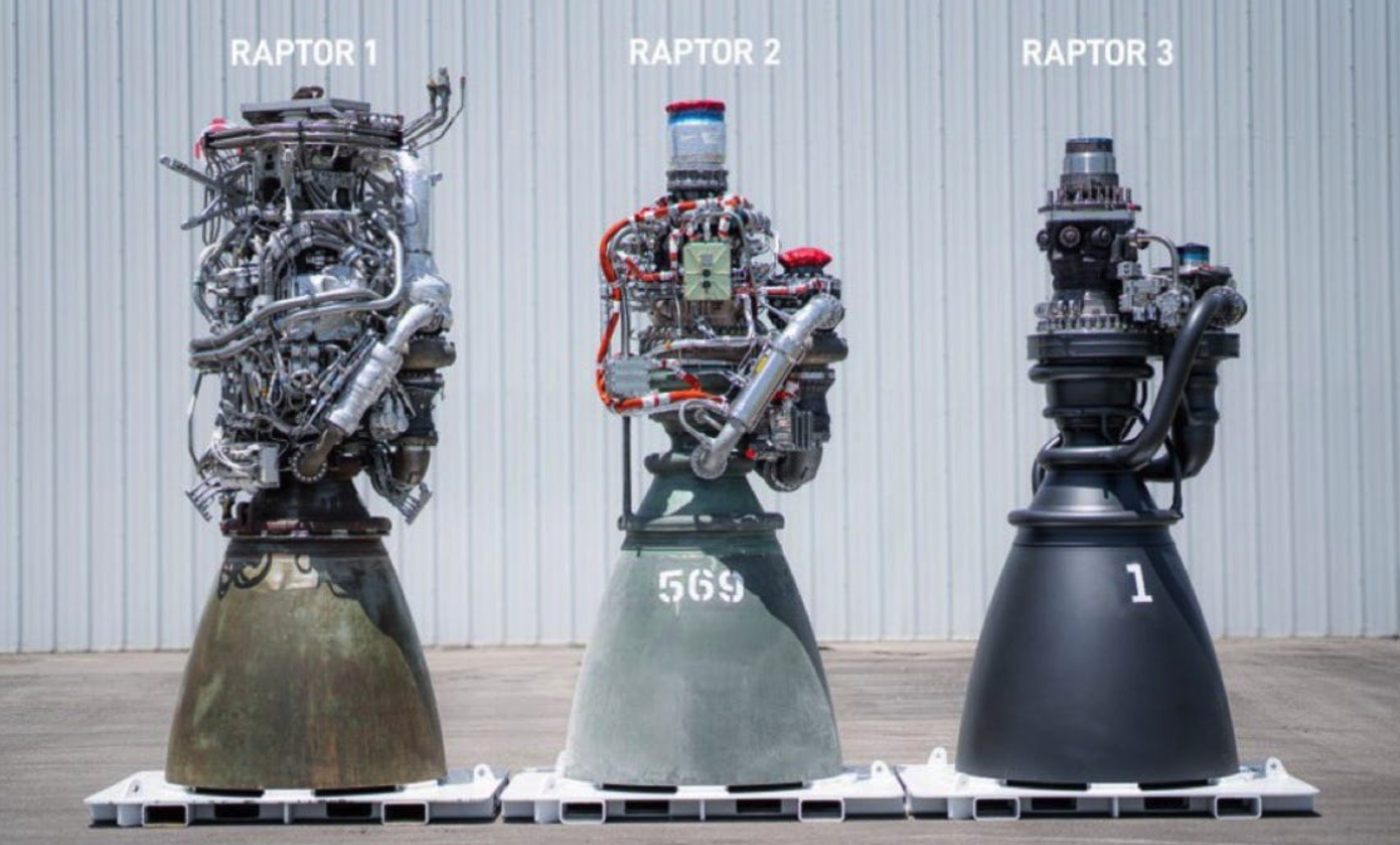

It is specialization of labor. So I think in the United States historically and today, we are extremely good, I think we are the best in the world at three things, entrepreneurship, service, and very high end manufacturing like planes and, and rockets. I think we are the best in the world at that, but just like the plumber is much better at other things than I am, there are things that other countries are way better than the United States at manufacturing a lot of certain goods, particularly mass goods, particularly lower end goods like clothing and shoes.

I spoke to A CEO last week, and he told me something that was helpful in my thinking here. He said, look, if you give instructions to Chinese workers and you say, here’s how to make this part, here’s step one, step two, step three, they are better than anyone in the world at making that part.

They can do it cheaper, faster, more efficiently, higher quality. But if you went to those Chinese workers and you said, please go design me a new part, they’re not that good at it. Americans are way better at that task than assembling that part, and that’s why the back of your iPhone says, designed in California, made in China.

That’s exactly what he was speaking to.

So look, my, my standard asterisk here, you might disagree with that. You might have different views. None of this is black and white, but the statements about it almost always are, which makes this a hard thing to talk about. So if you disagree with those views, lemme say it again. I respect you. I would listen to you. I’m just putting my cards on the table.

One big factor that I think gets lost here. And I’m gonna speak in a second why I think there is such a push among certain people for tariffs and why they think there is the need for them. I’m going to speak to that in a second, but one factor that I think is very lost here is that, yes, the United States has lost a lot of manufacturing employment over the last 50 years.

Of course, it absolutely has. And often when that is addressed, it is immediately jumped to, that’s because we ship those jobs overseas. The factories that used to be in Indiana and Tennessee and Mississippi, we shipped them to Mexico and Canada and China. There is some truth to that. Of course, indisputably. There is, I think, a bigger truth that gets lost, which is that where a lot of those jobs went was not necessarily to another country, it was to automation.

My favorite example of this, I wrote this 10 years ago, I had to go fish this up from an old article that I wrote is about a US steel factory in Gary, Indiana. In 1950, this individual factory produced 6 million tons of steel with 30,000 workers. In 2010 it produced seven and a half million tons of steel with 5,000 workers. So during this period, they increased the amount of steel that they were making, and they did it with 25,000 fewer workers. They went from 30,000 workers to 5,000. That story, I think, can be repeated across virtually everything that is made in the United States and around the world over the last 50 years.

Very interesting thing that I read the other day: China, the manufacturing powerhouse of the globe, has fewer manufacturing workers today than they did 10 years ago. They’re making more stuff than ever before. They’re building factories faster than ever before, and they have fewer people working in those factories because China, more than anybody else probably throughout history, is installing and using robots and automation in their manufacturing at a ferocious pace.

And so you can keep making more and more stuff but you need fewer and fewer people working on those assembly lines. That is often lost in the debate because if we were to bring back the manufacturing capacity to the United States, and that’s a separate debate, that’s a much longer debate, but let’s say that we do, it would not in any circumstances bring back the manufacturing jobs and the employment levels that we had in the 1950s. It’s a very different world today than it was back then. One way to get a very good view of this is to go onto YouTube and search for a video of Tesla factories. Because Tesla, very similar to China, is big on automation in its assembly and robots. And compare a modern Tesla factory to the 1950s Ford assembly line. It could not be more night and day, it could not be more different. The modern assembly line is robots and machines. Versus the assembly line back in the 1950s, which was biceps and backs and legs. That today has been replaced by automation.

One other example of this in the auto industry in 1990, not that long ago, the average American auto worker like working on an assembly line, their share of total auto production was about seven vehicles per year. So take the number of vehicles that were produced in the United States, divide that by the number of auto workers, and it was about seven.

The average worker was responsible for seven vehicles per year by 2023. Again, that’s just like one generation apart. Not even that much. The average auto worker in the United States was responsible for producing 33 vehicles per year. It went from seven to 33.

So we are, we are still producing a lot of cars in the United States. We still make a lot of vehicles here in the United States. It just does not require the amount of labor that it used to.

Just a few years ago, the economics journalist Neil Irwin wrote, “in the newest factories, one can look across an airplane hangar size floor, and see only a small handful of technicians staring at computer screens, monitoring the work of the machines. Workers lifting and pushing and riveting are nowhere to be seen.” And so I think that that is how manufacturing works today. It is very high output and low head count. At least much lower than it used to be.

So even as a US faces a manufacturing boom, which it has by the way in the last decade, easy to overlook, that manufacturing just can’t be expected to create the kind of employment that you saw many decades ago.

Okay, so that is a good leadway into another topic, which is about what the world was like during the golden ages of manufacturing that we remember, you know, the people who are working in the auto plants and the steel mills in the 1950s and the 1960s and through the 1970s, I think that is by and large the world that a lot of people want to go back to. Very understandable. I do not look down upon them for wanting to go back to that world in the slightest because it was a great world. It was amazing when there were tens of millions of manufacturing jobs in the industrial parts of the United States.

The people who did not go to college, or even people who did, could go get and earn good wages, that was great. It was a wonderful thing, but lemme tell you at least part of why it occurred at the time. At the end of World War II in 1945, Europe and Japan were decimated into rubble. Whereas the United States, of course, had all of its manufacturing capacity intact and had all these gis coming home.

There were 16 million GIs who came home in 1945 and had all this pent up demand to buy homes and washing machines and cars and all the new gadgets. And because Europe and Japan were in rubble, America, by and large had global manufacturing to itself. It had like a monopoly on global manufacturing at the time because Europe and Japan was still trying to build themselves back from the devastation of the war.

China at this period was still kind of an economic backwater, wasn’t really part of the equation. It was also trying to recover from the ravages of World War II. Places like India and Bangladesh and Thailand that manufacture a lot today weren’t really part of the global manufacturing equation back then.

There was this period when, because of the state of global geopolitics, America had a manufacturing dominance to itself for a good 20 years from probably 1945 through the end of the 1960s. That was also a period when, for many different factors, we don’t need to go into all of them, but white collar workers were not making that much money.

If you worked on Wall Street in the 1970s, that was not a place to make a lot of money. That was an admin accounting job that was not very looked highly upon because you didn’t make that much money. Bankers were not making nearly the kind of money that they made in the decades before or after. This period, and that was important because the blue collar manufacturing workers, by comparison to others in the economy, to others in their town, were doing great.

So even if their wages were lower back then than they would be today, even adjusted for inflation, when the manufacturing worker compared themself to the banker or the accountant, or the lawyer or the doctor, by comparison, he said, I’m doing pretty great. I’m doing pretty well. And then two things happened starting around the 1970s that really accelerated in the eighties and nineties, which was one Japan and Europe kind of after having recovered from the ravages of World War II became manufacturing powerhouses in their own right.

One of the first signs of this was when Honda, Nissan and Toyota started selling cars in the United States, and people realized in the US that, Hey, actually. These are pretty good cars. These aren’t bad. It was easy to look down upon ‘em at first because they were small and had tiny little engines relative to the Chevy Camaro or the, the T-Bird, but this came during a period in the seventies and eighties when gas prices surged and all of a sudden those tiny little engines in a Honda Civic or a Toyota Corolla we’re what people wanted. And then all of a sudden, out of the blue, you went from incredible American dominance in car manufacturing from gm, Ford, and Chrysler to Honda, Toyota, and Nissan actually taking a lot of market share.

There’s a very good book I read a couple months ago. It’s called The Reckoning, and it’s about Ford’s decline and Nissan’s rise during this period, from the 1950s to the 1990s. And a lot of what happened to, to state it very generally, it’s more complicated than this, was companies like Ford, a GM in Chrysler, had so much dominance during this period, fifties, sixties, seventies, that when they started facing competition from foreign imports in the eighties and nineties, they kind of lost their way. They had such a stranglehold monopoly on auto manufacturing that they became much less competitive. And as I said earlier, that is one function that tariffs implement is when you don’t have to compete with foreign suppliers.

You become much less competitive. You become kind of fat and happy and lazy. In a way, and that was kind of the, the broad thesis of this book was that Ford became fat, happy, and lazy while Nissan and other Japanese auto manufacturers were just surging.

And so the manufacturing dominance, not just in autos but in lots of things, heavy machinery and whatnot, started to erode in the seventies, eighties, and nineties, and really started to explode higher in the two thousands when China really came on board in terms of global manufacturing. And that occurred at the same moment when white collar workers.

And finance and accounting and office jobs started making fortunes huge sums of money. So now at the same moment that the manufacturing worker was losing their jobs both to automation and foreign competition, the white collar workers were, were just having a field day and making money hand over fist, which made what manufacturing jobs existed feel even worse by comparison because let’s say you’re an auto worker making $25 an hour in one era, that might feel great, but if all of a sudden your neighbor who is a project manager at KPMG is making 300 grand a year, your $25 an hour doesn’t feel that great anymore. ‘cause your neighbor has, has a bigger house and more cars and is sending their kids to private school.

So by comparison, you feel worse off even if your wages adjusted for inflation may have been going up. And so you put all of that together. That is a very. Shorthand history. Of course, there are a billion variables that I left out in there, but I think that shorthand history is in broad strokes what has happened over the last 80 years.

It is so understandable that you have millions of workers who say, this economy worked for me 50 years ago and it doesn’t today. My dad, my grandpa had great jobs in the GM factory and I can’t have that today. So understandable that that would be the thought process of millions of workers, and I think it is naive and insulting for people who are on my side of the tariff debate who say tariffs are a bad idea who cannot understand the views of those kind of people. Because if I was in that situation, and if lots of people who disagree with tariffs were in that situation, they’d be arguing for the same thing.

I think one of America’s strengths over time, this has been true for hundreds of years, is this sounds kind of crazy, but I think it’s true. A firm belief in things that are probably not true. That has always been a strength of the United States. This goes back to the very early days of the settlers and the colonizers, whom back in Europe were told that America was a land of absolute abundance.

And when you got there, there would be just, you know, rivers overflowing with gold and whatnot. And actually it was like a malaria swap when they got to the East coast of the United States. But we believed it was always believed that this was the promise land. That was what brought the people over. And even when they came to the United States and settled. It was that belief too. America has always been so unbelievably optimistic, particularly at the individual level, and that’s why I think we’re so good at entrepreneurship. It’s this idea that you, the entrepreneur, even if you start as a, nobody can make it to become the next Elon Musk, Bill Gates, Henry Ford, Thomas Edison. You can make it. You can do it. Not a lot of other cultures have that level of even like optimistic ignorance, because in many ways that’s what it is. But what that’s done is it’s created this incredible entrepreneurial society that has given us and the world some incredible world changing innovations in companies over the years.

And when I pair that belief with the observation that there are tens of millions of Americans who feel like the world doesn’t work for them anymore, who feels like this economy is not working for them anymore. That worries me. It worries me that a meaningful chunk of society does not have that optimistic ignorance. I mean that in a positive sense to think that, hey, the world is my oyster. The sky is the limit. I can go do it now. We’ve been through similar periods in the past, the 1930s, the 1970s, and we recovered from those. We recovered from those malaise periods, and I’m optimistic that we’ll recover from it this time, but we should not lose track of the fact that we are in one of those periods again.

Where this goes next, my guess is as good as yours. And both of our guesses are useless beacuse I don’t think anyone knows what’s gonna happen next. Interestingly, many of you will listen to this podcast the day that I publish it, which I guess is April 8th. Some of you will listen to it weeks in the future when half of what I just said will be outdated because the situation is changing so quickly.

That gets back to why I only want to do long-term words and why this is so against what I normally do. But let me say a couple of things about. Investing because that has been the initial reaction to the tariffs has been entirely in the stock market, which as I speak here, is down about 20% or so from its highs that were reached just a couple weeks ago.

Now, the tariff impact has not hit the broader economy in terms of inflation at the grocery store or mass layoffs or whatnot. But so far it’s been in the stock market. So even if that is a very minor part of what will impact the economy, let me speak to that just a bit. I, of course have, have been glued to Twitter over the last week just trying to understand what’s happening and hear other people’s views.

I’ve watched it with a sense of shock and just confusion trying to piece together what’s happened, but it has not in the slightest changed how I invest, and I extremely doubt that it ever will. I think it is possible to be an engaged and informed citizen, even a social media junkie reading the news and a calm investor at the same time.

I purchased stocks early last week, not because of anything that was going on in the news, but because you gotta do that every month around the first of the month. I do it every single month. I’ve done that for, uh, I don’t know, 20 years now. I’ll do it next month. I’ll do it the month after that. That won’t change. I think it, it never changes. So I think you can simultaneously dollar cost average. Remain long-term, optimistic, not panic about anything that’s going on in the world. You can enjoy life, spend time outdoors, hang out with your kids, eat good food, listen to good music, have a good time, and at the same time, if you are of the same belief of me, realize how destructive and unnecessary what we’re going through is.

You can do all of that at the same time. It’s not like you have to be optimistic or pessimistic. I am very optimistic on the long term, even if I think this is a bad idea, that’s not a contradiction. Something else I’ve been thinking about is that we have in the past been through much more uncertain times than we’re going through right now, but it never feels that way, or it rarely feels that way because when we think about the past economic crises, COVID, Lehman Brothers, 9/11, Pearl Harbor, those kind of events. We know how the story ended and we know that the story did end and we know that we eventually recovered. But whenever it is a current crisis, a current period of uncertainty, you don’t know that. You don’t know when it’s going to end. You don’t know how it’s gonna end, and some people don’t know if it will ever end.

And because of that, even if, I think without a doubt what we’re going through is less uncertain, less serious than other periods of economic upheaval. It rarely feels that way because we don’t know what’s gonna happen next. So every crisis has its own little unique flavor of what’s going on. But the common denominator is this feeling that you can’t see the future anymore. And that makes people go crazy in, turns them into political junkies. It makes ‘em make bad investing decisions. That’s always been the case. Try to avoid that. I would also say that for most investors, 99% of good investing is doing nothing.

Most investing is just not doing anything, not trading, not selling. Just letting your money sit there and to hopefully grow over the years and decades. That’s 99% of good investing. 1% of good investing is how you behave when the world is going crazy. And this, I think, is one of those periods when the market falls 20% in a week.

That is one of those periods when it is so absolutely vital that you keep your head on straight. A lot of people will mix their investing decisions with their political beliefs, and 99% of the time, that is a mistake that you are not gonna make good investing decisions if you are doing it through the lens of your tribal beliefs.

Whatever those beliefs might be. Napoleon’s definition of a military genius was quote, the man who can do the average thing when everyone else around him is losing his mind. I’m gonna repeat that because it is such a ridiculously good quote. A military genius is the man who can do the average thing when everyone else around him is losing his mind.

It is the exact same in investing to be a good investor over time. You don’t need to make a lot of genius decisions. You just need to be merely average when everyone else is making bad decisions, as many people are.

One other thing that’s very different from this period, these, this tariff period that we’re going through, if you compare it to other periods of economic upheaval like Covid and Lehman Brothers and 9/11 and Pearl Harbor, is that this could end. In the next hour, right? Like the, these tariffs could be immediately removed in the next hour.

Or even if it’s not that there could be certain laws, whether it’s from the courts or from Congress, that could end these very quickly. Obviously we didn’t have that with Covid. There was no button on anyone’s desk that said, remove the virus, just click this button. We do have that now.

And so what is very different about this is how quickly it could end, and if that were to happen, how ferocious. The rally in stock markets would almost certainly be, even if there was some permanent damage, because global trading partners don’t trust us as much as they used to this, as such a unique period of economic crisis because with the flip of the switch and the stroke of the pen or a single tweet, it could all end.

And I don’t think I can’t think of another economic crisis that was similar to that. Obviously that was, there’s no analogy for that in terms of 9/11 or Pearl Harbor or whatever. The other thing I would state, maybe I’ll end with this, is that in every period of economic upheaval and political upheaval, it is so easy to underestimate the counter forces that come from it.

When things are declining, when things are getting worse in your eyes, it is easy to extrapolate and say, well, it’s gonna keep getting worse forever. It’s very difficult to envision the counter forces of. People’s reactions and lower stock market valuations that push in the other direction. It is true in every single previous bear market that those counter forces set the seeds for the next bull market, but virtually nobody saw them coming at the time.

That lower valuations plant the seeds of the next bull market, that people becoming frustrated with this political environment. Push for change. It’s always difficult to see those, but they always happen. That is happening right now at this moment. There are counter forces all over the place that are setting up the next bull market.

Now, I have no idea when that’s gonna begin. It might start tomorrow. It might start six years from now. I have no idea, but it’s always in play and it’s easy to overlook and it leaves people more pessimistic than they should be. And so as I end this rant, that will be a departure from what I normally write and speak about,

I’ll end just by saying I’m as optimistic as I’ve ever been, particularly for the long term. I’ve always talked about the idea of rational optimism, which is the idea that I am very optimistic that the world is gonna be a better, wealthier place 20, 30, 40, 50 years from now, but I’m rational in the belief that it’s gonna be very difficult between now and then.

The path between now and then will be extremely difficult. I wrote about that many years ago, and as I sit here in this unique week, unique period, maybe that’s the belief that I always come back to. Very optimistic about the long term, even if I’m understandable about how difficult it will be to get there.

In 2015, Collaborative Fund made an unusually bold bet—investing $5 million—20% of a $25 million fund—into a single startup. Less than five years later, that one investment returned over $100 million, singlehandedly quadrupling the entire fund.

Was this risk justified? Should a fund spread $25 million across twenty-five $1 million bets or five $5 million ones?

This wasn’t only a lucky outcome; it was also a deliberate choice rooted in conviction. Venture capital returns famously follow a power law—a tiny fraction of investments often generate the majority of returns, both for a given fund and the entire industry each year. The challenge is structuring a portfolio to catch at least one of these breakout outcomes without over-diversifying and diluting returns.

This post examines the math behind portfolio construction, the trade-offs between concentration and diversification, and why exceptional outcomes often come from high-conviction positions.

The flawed math behind venture portfolio construction

Venture investing is often called an art, but that doesn’t stop people from trying to turn it into a science. Many funds use math to guide portfolio construction, helping to estimate how many bets to place and how much to allocate per investment in a given fund. These range from probability-driven frameworks like the Kelly Criterion to simulation-based modeling like Monte Carlo.

No model perfectly captures the reality of venture capital. Each has flaws, assumptions, and blind spots. Some fail to account for the extreme variance in startup outcomes, while others assume investors can accurately predict success rates—something historical data suggests is extraordinarily difficult.

Still, these frameworks can help ballpark an approach. Below are some of the more common ones and their limitations.

Kelly criterion

Originally developed for gamblers, the Kelly Criterion calculates the optimal bet size to maximize long-term returns. In VC, it can be used to help determine the proportion of a fund to allocate per startup.

Why it isn’t a perfect fit for VC:

- You don’t know exact probabilities of success or payouts—Kelly assumes you do.

- It assumes you can reinvest winnings each round, but in VC, capital is typically locked up for a decade.

Back of the envelope power law math

Some VCs take a probability-driven approach to ensure their portfolio includes at least one breakout winner. The basic logic goes like this:

- Assume a startup has a 5% chance of delivering a 20x+ return.

- If you invest in just one company, there’s a 95% chance you miss a big winner.

- If you invest in two, the chance of missing a winner drops to 90% (95% × 95%).

- Keep investing, and the odds of missing a winner continue to shrink.

From here, one can set a threshold for failure—say, wanting a 20% or lower chance of having zero breakout winners—and backsolve to determine how many investments to make (32 in this case).

Why it isn’t a perfect fit for VC:

- The failure threshold is arbitrary—too low, and you dilute your best bets; too high, and you risk missing a winner altogether.

- It treats startup outcomes as binary (big winner or bust), ignoring the reality that many exits fall somewhere in between.

- A more nuanced approach would factor in different return profiles and optimize accordingly.

Monte Carlo simulations

This method runs thousands—sometimes millions—of randomized scenarios based on assumed success rates and exits, testing different allocation strategies to identify the best.

Why it isn’t a perfect fit for VC:

- Like all models, Monte Carlo is only as good as its inputs. Assumptions about success rates and exit values are just that—assumptions. Even using robust historical venture data doesn’t guarantee reliability.

- For example, AngelList ran Monte Carlo simulations using data from 3,000+ past investments. One might expect a dataset of that size to produce generalizable conclusions. However, adding just a few breakout investments drastically altered the projected returns:

- Adding Peter Thiel’s Facebook seed investment shifted the average return from 2.7x to 5.9x.

- Including Google’s and Uber’s seed rounds pushed it to 27.7x.

- Monte Carlo is useful for modeling potential outcomes and assessing risk, but it can’t predict the future. Even running simulations on a perfectly curated dataset of every VC deal from the last decade wouldn’t ensure reliable forecasts—past performance isn’t indicative of future results.

So… how should you construct your portfolio?

Each of these methods has flaws, but together, they offer a rough picture of effective venture portfolio construction.

They suggest that early-stage funds should aim for 25-40 investments per fund. This range balances the potential for capturing breakout winners while avoiding excessive dilution.

However, portfolio construction isn’t just math—it’s strategy. Models can give a broad range of appropriate portfolio concentrations, but they can’t tell you exactly how many bets to make or when to make a single more concentrated bet. Our decision to allocate $5M—20% of our fund—into a single company wasn’t model-driven. In fact, most models would have cautioned against it.

Below are some strategic reasons for varying degrees of portfolio concentration.

Arguments for less concentration

- Firm longevity: A broader portfolio increases the odds of landing a power-law outcome. An overconcentrated fund that strikes out may compromise future fundraises. LPs won’t tolerate a decade of locked up capital for a <1x MOIC. Diversification may sacrifice upside in a single fund, but it can keep a firm in the game. If our $5M bet had missed and the rest of the portfolio underperformed, our concentration strategy would have been scrutinized, potentially leading to some tough conversations with LPs.

- Leading vs. following: Larger checks often mean leading rounds, which comes with extra responsibilities—diligence, term negotiation, and board seats to name a few. Not all firms are structured and willing to lead.

- Poker analogy: Fred Wilson compares early-stage investing to poker. Players put in a small ante to see their cards before deciding whether to bet a larger amount. Similarly, a small early check secures a seat at the table, giving investors time to assess execution from the inside. A diversified approach in early stages increases exposure to potentially strong performers, enabling investors to deploy follow-on capital with greater conviction in subsequent rounds.

Arguments for more concentration

- Conviction: When a standout team, market tailwinds, and early traction align, a concentrated investment can be the right move. While conviction should underpin every investment (ideally), some opportunities inspire greater confidence than others. When that happens, check size should reflect it.

- Deeper involvement and better follow-on decisions: A concentrated portfolio lets investors be more hands-on, building stronger relationships with founders and offering targeted support. With fewer companies to track, follow-on decisions are also more informed.

- Quality over quantity: More deals can mean spreading capital too thin or investing in lower-quality startups just to fill a portfolio. If a fund can reliably identify its strongest investments at the time of investment, concentrating more on those maximizes returns.

- Top-tier funds tend to concentrate capital: Data shows higher-performing funds tend to be more concentrated. Whether through larger initial checks or follow-on investment, they focus on companies with the highest potential for outsized returns.

Conviction and check size dynamacy

Our $5M bet wasn’t one of five evenly sized investments within our $25M fund—it was an outlier. The fund made 20 investments, keeping it relatively concentrated, but this check was unusually large. It was placed with conviction, and in hindsight, it paid off.

Had this bet failed, we would have reassessed our approach to concentration. Big swings carry big risks, and a miss would have been a tough reminder of the balance between focus and diversification.

While we haven’t committed 20% of a fund to one company since, this experience reinforced conviction’s role in our portfolio construction. Since then, we’ve leaned on it more heavily, ensuring we’re positioned to bet big when the right opportunity presents itself.

Venture capital is as much an art as a science. The real challenge isn’t just portfolio sizing—it’s knowing when to take a concentrated risk and having the discipline to live with the outcome, whether it’s a hard-earned lesson or a $100M success.

Past performance is not indicative of future results. There can be no assurance that any Collaborative Fund investment or fund will achieve its objective or avoid substantial losses. All returns, including MOICs, shown herein are gross returns. Gross returns do not reflect the deduction of management fees, carried interest, expense, and other amounts borne by investors, which will reduce returns and in the aggregate are expected to be substantial. Certain statements contained herein reflect the subjective views and opinions of Collaborative Fund. Such statements cannot be independently verified and are subject to change. In addition, there is no guarantee that all investments will exhibit characteristics that are consistent with the initiatives standards, or metrics described herein. Performance information shown herein is for a subset of Collaborative Fund investments.

I heard a phrase recently: “Magazine architect.”

It’s a derisive term architects use for their colleagues who design buildings that look beautiful, grace magazine covers, and win awards, but lack functionality for the tenants.

Intricate roofs look amazing – and are notorious nightmares for leaking.

Oddly shaped buildings win awards – and offer little flexibility to remodel interior layouts.

Fancy materials glisten—but good luck finding someone skilled enough to maintain or replace them.

Ornate lobbies take up tremendous space – and are often not used by occupants, who enter through the garage.

The book How Buildings Learn writes that architects fancy themselves as artists, but people who occupy buildings do not want art; they want a building to work in:

Art must experiment to do its job. Most experiments fail. Art costs extra. How much extra are you willing to pay to live in a failed experiment? Art flouts convention. Convention became conventional because it works. Aspiring to art means aspiring to a building that almost certainly cannot work, because the old good solutions are thrown away. The roof has a dramatic new look, and it leaks dramatically.

The book cites renowned architects like I.M. Pei and Frank Lloyd Wright for designing buildings admired by everyone except their occupants, whose feelings tend towards frustration and disgust. Frank Lloyd Wright once said of his infamously leaky roofs: “If the roof doesn’t leak, the architect hasn’t been creative enough” – an amusing comment to everyone but those living in his homes.

The flip side is that office buildings with happy tenants tend to be big, boring, rectangles built with classic materials. They will win no awards and grace no magazines. But the roof is tight, the layout is flexible, and the HVAC system is located where it should be. The true purpose of a building – a place that helps you do your best work – is achieved.

I like art and can appreciate architecture. But the idea that there is a time and place for beautiful vs. practical should be recognized. And the idea that if you are looking for practical advice, beware hiring an artist whose goal is to be praised should be, too.

Is that true for many things in life?

Jason Zweig once wrote about investing:

While people need good advice, what they want is advice that sounds good.

The advice that sounds the best in the short run is always the most dangerous in the long run. Everyone wants the secret, the key, the roadmap to the primrose path that leads to El Dorado: the magical low-risk, high-return investment that can double your money in no time. Everyone wants to chase the returns of whatever has been hottest and to shun whatever has gone cold.

A lot of financial advice is beautiful and intelligent but has no practical purpose for the person receiving it.

It happens for a couple reasons.

One is that, like architects, financial professionals may want to further their career more than they want to help their clients. I think this is usually innocent: It’s easy to be blind to what your clients need when your business is so profitable and you’re gaining so much attention.

“Look how much money I’m making and how often I’m asked to come on TV” can be interpreted as “I am adding so much value.” Sometimes that’s true; often it’s not. An intense and complex derivatives strategy can make you sound brilliant and bring in buckets of fees, and also be the opposite of what a client actually needs. It’s telling that the company that figured out how to provide low-cost index funds – Vanguard – could only do it as a non-profit. There’s a mile-wide gap between what many clients need and what generates the most fees. A lot of people need the financial equivalent of a rectangle building but are sold a gorgeous geodesic dome with a leaky roof and no garage.

The other reason is that no two people are alike, and financial advice that’s useful for you could be disastrous for me and vice versa. There is no one-size-fits-all financial plan – a fact that’s easy to overlook because people want to think of finance like it’s physics, with clean formulas and absolute answers. When advice needs to be personal but you think it’s universal, it’s common to default to what sounds the best, the most intelligent, and the most complex. People drift from practical towards beautiful.

I watch financial markets every day because I think they’re a window into culture and behavior. They’re so fascinating, so beautiful, like art. But my personal finances are simple and boring. They will win no awards. But they’re practical for me and my family. They provide what I need them to do. Isn’t there beauty in that?

A simple formula for a pretty nice life is independence plus purpose.

Purpose is different for everyone. Sometimes it’s family, sometimes it’s community, religion, work, whatever.

But independence is more universal. Our desire to be independent, why we want it, what prevents us from achieving it, and why some people sabotage their ability to have it, is such a common story across cultures and generations.

I have a parenting story.

My son has always been shy. Painfully shy. At times it’s adorable; at times my wife and I worry. Pre-school teachers gave up trying to get him to participate in group activities – he would sit by himself in the corner watching other kids play. He wouldn’t trick-or-treat one year because the thought of knocking on a stranger’s door could bring him to tears. We almost didn’t make it through airport security once because he refused to tell the TSA agent his age (he was eight).

But we had confidence he’d improve. And like most kids, he has.

Last week we were at a pool and he asked if he could get ice cream. I said yes, but you have to do it by yourself. You have to order it yourself, hand her the money, take the change – all of it. I’m not even going to be nearby.

“I can’t do it,” he said.

“That’s OK, you don’t have to” I said.

He paused.

“But can I still get ice cream?”

“Yes, but you have to do it yourself,” I said.

Another pause.

“What if I get in trouble?” he asked.

“For what?”

“What if they tell me no because I’m a kid?”

“They won’t. But even if they do, it’s fine,” I said. “You won’t be in trouble.”

I could see the gears turning in his head. He wanted to do it so badly.

“I don’t know,” he said. “I’m so scared.”

Another pause.

“I can’t do it.”

It’s difficult as a parent to, on one hand, want to shower your kids with protection and help while, on the other, know how important it is to teach them independence. “Teach” is probably the wrong word, because you know they’ll figure it out on their own. Sometimes you provide the most help with the assistance you withhold.

My son walked off. I had no idea what he was going to do.

A few minutes later he came back – absolutely beaming – with a bowl of ice cream.

This story might seem benign to other parents – or even bizarre if you’re used to a gregarious kid. But in the context of his past, it’s hard to describe its impact. He was so proud of himself.

If I had gone with him and held his hand through the process, the ice cream would have given him a small happiness boost. When he did it on his own terms, with a sense of independence, the psychological rewards were off the charts.

I’ll tell you the takeaway: If you’re used to being assisted, supervised, mandated, or dictated, and then suddenly you experience the glory of independence, the feeling is sensational. Doing something on your own terms can feel better than doing the exact same thing when someone else is peering over your shoulder, telling you what to do, guiding you along.

And that’s as true for adults as it is for kids getting ice cream.

Independence is the best financial goal for most people. But independence is more than just financial – moral, cultural, and intellectual independence – is one of the highest levels you can reach in life. “There is only one success,” says poet Christopher Morley, “to be able to spend your life in your own way.”

Derek Sivers once put it a different way:

All misery comes from dependency. If you weren’t dependent on income, people, or technology, you would be truly free. The only way to be deeply happy is to break all dependencies.

That’s why independence – financially, intellectually, morally – is one of the highest goals you can achieve.

Here are a few things I’ve thought about with independence.

1. Independence is the only way to recognize individuality.

I read this great quote recently from an early Amazon employee:

Jeff [Bezos] said many times that if we wanted Amazon to be a place where builders can build, we needed to eliminate communication, not encourage it.

The idea is that if you want to do something great, you cannot have a group of people constantly telling you what you’re doing wrong and why it doesn’t mesh with their own goals. That’s not because those other people might be wrong; it’s because they might be playing a different game than you are.

In business, finance, and everyday life, a great decision for me might be a terrible decision for you and vice versa. If everyone had the same goals, the same family dynamics, and the same personalities, we could make finance a hard science and say, “Here’s how everyone should save and invest.” But it’s not like that. The difference in how you and I want to live our lives – what our own definition of success might be – can be 10 miles wide. A potato farmer and a hedge fund manager might be equally happy, all while looking at the other as if from a different planet.

A lot of financial mistakes come from decisions that would be right for someone else but wrong for you. They are the most dangerous, because smart people around you say, “This worked for me. It changed my life. You should do it too.”

Here’s another thing I read recently, from G. K. Chesterton:

Ideas are dangerous, but the man to whom they are least dangerous is the man of ideas. He is acquainted with ideas, and moves among them like a lion-tamer. Ideas are dangerous, but the man to whom they are most dangerous is the man of no ideas. The man of no ideas will find the first idea fly to his head like wine to the head of a teetotaller.

If you have no strong views on what kind of life you want to live – who are you, what you desire, what makes you happy and what doesn’t – you’re likely to want to mimic the most visually appealing person you come across (often the person with the biggest house, fastest car, or nicest clothes). That may work, it may not.

And so it’s vital to constantly reflect on who you want to be, what kind of life you want to live, and ask if you’re on an independent path versus chasing someone else’s dream.

2. Independence in thought, philosophy, morals, and culture are as important as financial independence.

Charlie Munger once listed three practical rules for success:

Don’t sell something you wouldn’t buy.

Work for people you admire.

Partner with people you enjoy.

So simple.

I have seen many people achieve some level of financial independence only to be sucked into a new kind of dependence: the culture of their tribe. Financial freedom is achieved, but it’s replaced with sycophancy to a new boss, or a blind adherence to tribal views you might disagree with deep down.

It’s a unique form of poverty: rather than needing to work for money, you are indebted to needing to think a certain way.

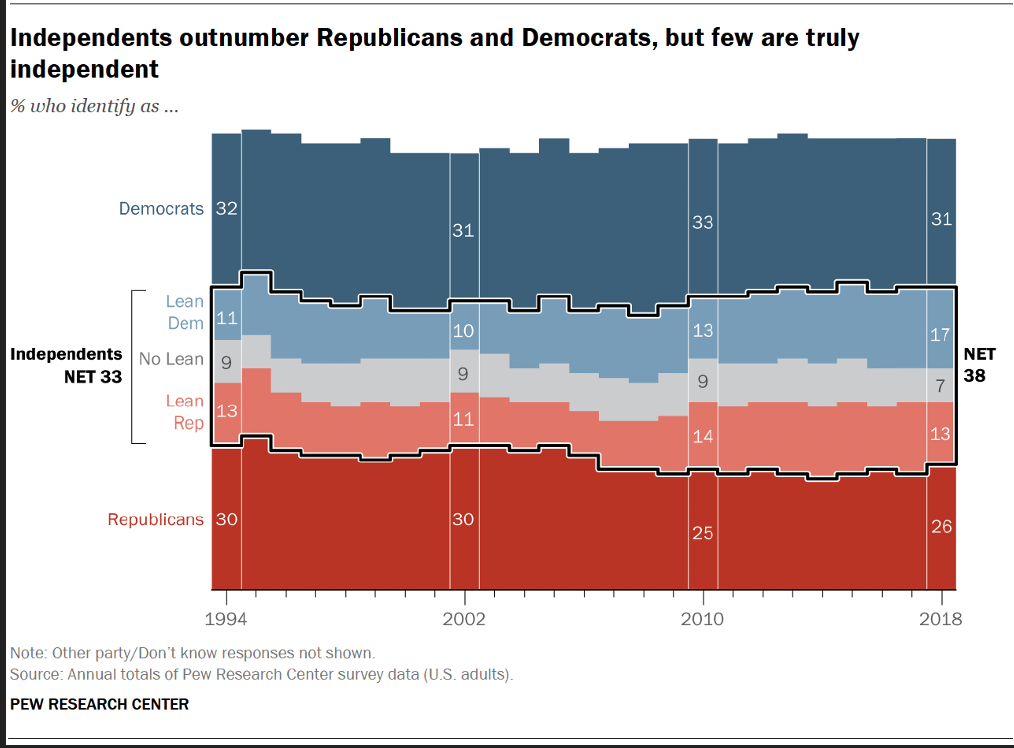

I once heard a good litmus test: If I can predict your views on one topic by hearing your views about another, unrelated topic, you are not thinking independently. Example: If your views on immigration allow someone to accurately predict your views on abortion and gun control, there’s a good chance you’re not thinking independently.

There are so many different versions of this: The salesman who doesn’t believe in his products, the worker who secretly thinks her boss is crazy, the employee who can’t stand his highest-paying client, the voter who nods along while wincing inside.

There’s a difference between the practical need to accept different views and pretending to agree with different views, especially if you’re just doing it for more money.

Investor Ed Thorp once said: “It is vastly less stressful to be independent—and one is never independent when involved in a large structure with powerful clients.”

Less stress is a good point. It’s mentally exhausting to pretend to be someone you’re not. It’s part of why so many people look forward to retirement: it may be the first time in their professional lives they can truly be themselves.

Financial independence is easy to grasp – you no longer rely on others for income. Intellectual and moral independence is more nuanced, but not having it is a unique form of debt.

3. When you’re independent you feel less desire to impress strangers, which can be an enormous financial and psychological cost.

Speaking of hidden forms of debts: How much of what takes place in our modern economy is done purely for signaling reasons? It’s impossible to quantify, but you know it when you see it. And taking an action to impress other people is a direct form of dependence. It happens in many different ways:

-

Physical signaling (clothes, cars, homes, jewelry)

-

Clout-chasing (desperate for social media engagement)

-

Tribal signaling (political battles, status superiority, election bumper stickers)

-

Moral signaling (everything is us-versus-them)

Each of these is about measuring your own value through the opinions of others. Sometimes it’s direct (your net worth versus mine) and other times it’s more subtle (do you like me?). The person who is desperate for attention and acceptance from a group of strangers is hardly different from the person begging for money on the street.

The wild thing about all this effort is how easy it is to overestimate how much other people are thinking about you. No one is thinking about you as much as you are. They are too busy thinking about themselves.

Even when people are thinking about you, they often do it just to contextualize their own life. When someone looks at you and thinks, “I like her sweater,” what they actually may be thinking is, “That sweater would look nice on me.” I once called this the man-in-the-car-paradox: When you see someone driving a nice car, rarely do you think, “Wow, that driver is cool.” What you think is, “If I drove that car, people would think I’m cool.” Do you see the irony?

When you’re truly independent you rid yourself of this silly burden. It can be such a relief when you do. Only when you stop caring what strangers might think of you do you realize how much effort you may have previously put into their validation.

But let me make an equally important point:

4. Independence does not mean you don’t care what anyone thinks of you. It means that you strategically decide whose attention you seek.

I need the love and admiration of my wife, kids, and parents. I enjoy the presence and camaraderie of about five friends. I want to foster relationships with a small group of people I admire in my professional orbit.

But you can see how this funnel keeps tapering off from there.

When you independently choose who you want to include in your small circle of life, the actions you take, the work you pursue, and even the values you hold can completely flip. Rather than trying to appease everyone (foolish, impossible) you select the life you want to live and focus your attention on a smaller group of people whose love and support you deeply desire.

It’s the opposite of when business leaders and politicians pander for the support of the masses. On one hand you can say they are doing something that gets them what they want (power). On the other, how independent are you if the words you say and the actions you take are dictated by the beliefs of a group of people you’ve never met?

A related point here is that loyalty to those who deserve your loyalty is a wonderful thing. Family, genuine friends, companies who you deeply respect and admire – it can be so satisfying to offer your loyalty to someone who deserves it. But it’s rare, and only when you’re independent can you be honest about whether you’re being appropriately loyal or attached to the attention and money of people you secretly don’t admire.

5. Financial independence doesn’t mean you stop working.

This idea is related to the previous one: Financial independence is a wonderful goal. But achieving it doesn’t necessarily mean you stop working – just that you choose the work you do, when you do it, for how long, and whom you do it with.

Those who retire early tend to come from one of two camps:

-

They hated their work but kept doing it to make as much money as they could.

-

They enjoyed their work but quit when they had enough money.

To each their own, but both look like situations where money controls your decisions. The irony is that some people who think they’re financially independent are actually completely dependent on money, so much so that they spend their days doing things they’d rather not because money tells them they should. Rather than using money as a tool, the money used them.

6. Being independent doesn’t mean you’re accountable to no one. You become accountable to yourself, which is often when you do your best work.

Study any great creator – scientists, artists, entrepreneurs – and you’ll find an independent drive. They weren’t working to appease a boss or earn a paycheck; they were driven solely by their own curiosity and expectations.

When you’re working for someone else’s expectations, the path of least resistance is to put in the minimum required effort – or, worse, to give off the appearance of effort while not actually being productive.

I think almost everyone is creative. But it’s often hard to dredge up creativity when you’re doing it for someone else. In my profession: Writing for yourself is fun, and it shows. Writing for other people is work, and it shows. You do your best work when you’re doing it on your own terms.

I bet that applies to most fields.

And actually most of life.

If I told you a company was on track for $500M in sales in 2024 — up from $200M in 2023 and $70M in 2022 — and thriving thanks to massive secular tailwinds, what kind of business would you imagine? A cutting-edge AI company? What if I told you it was a soda company founded just five years ago in Oakland, California?

The flashiest companies don’t always deliver the highest returns for early investors. Let’s explore a comparison between two vastly different businesses: OpenAI and OLIPOP.

OpenAI is among the most influential and widely discussed companies in the world, and for good reason. It ushered in a golden age of LLMs, with staggering ripple effects: skyrocketing AI-related CapEx among tech giants, NVIDIA’s ascent to the world’s most valuable company by market cap (though it now ranks #3), and a dramatic resurgence in U.S. power demand growth.

Then there’s OLIPOP – a soda company. But not just any soda. OLIPOP makes a healthier alternative with gut-friendly prebiotics and plant fiber. Its nostalgic flavors, like Classic Root Beer and Vintage Cola, feel indulgent but deliver a BFY experience. It’s also delicious. Simple as that.

Comparison methodology

To compare the investment performance of OpenAI and OLIPOP’s first investors, we’ll use a simple returns multiple: the current value of their ownership divided by their initial investment. Since both companies raised their first rounds in 2019, this approach allows for a direct comparison, even though it doesn’t factor in timing (e.g., IRR).

For simplicity, we assume early investors did not participate in later rounds and were diluted. To calculate these returns, we need to determine:

- Size and valuation of each company’s initial equity round

- Sizes and valuations of subsequent rounds to account for dilution

- A reasonable estimate of their current valuations

- A projection of future dilution each company may face before exit

OpenAI’s returns

Founded in 2015 as a nonprofit focused on advancing AI safely, OpenAI restructured in 2019 to fund its expensive pursuit of AGI. It created OpenAI LP, a “capped-profit” entity governed by the original nonprofit (renamed OpenAI Nonprofit). This structure allowed OpenAI to raise private capital while capping early investor returns at 100x, with any excess profits flowing back to the nonprofit.

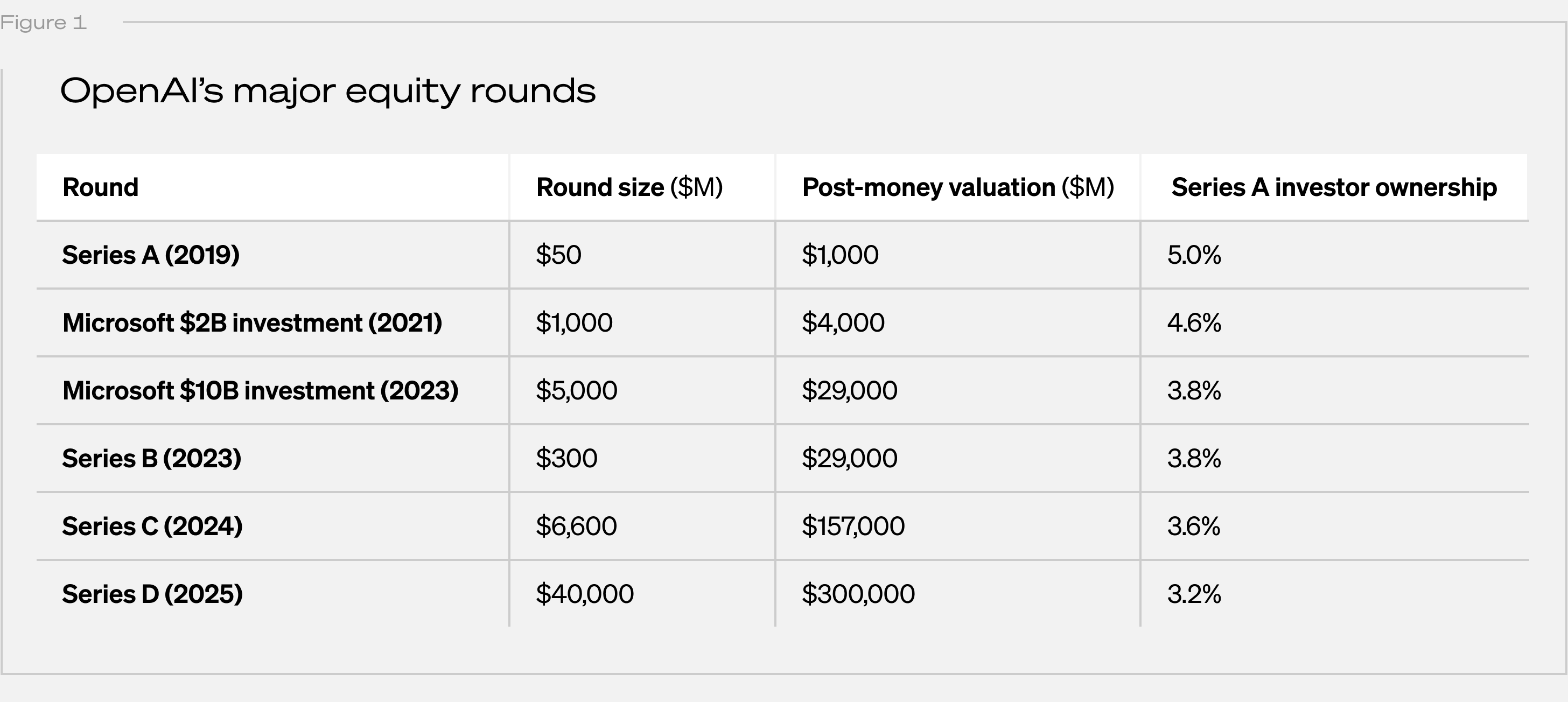

At the time of this change, OpenAI also announced its first institutional funding round, led by Khosla Ventures. Let’s call this their Series A. Details remain unclear: PitchBook lists it as a $10M raise at an undisclosed valuation, while other sources suggest Khosla’s stake alone was $50M at a post-money valuation of $1B. We’ll assume a round size of $50M for 5% ownership.

Estimating dilution is tricky. Most of OpenAI’s funding post-Series A has been from Microsoft, which has poured in ~$14B through a mix of equity, Azure credits, and unique profit-sharing agreements. Sources disagree on the details, but key reported investments include $2B in 2021 and $10B in 2023. Adding to the complexity, OpenAI is now transitioning to a for-profit public benefit corporation, which could eliminate the 100x cap on early investor returns.

To simplify, we’ll assume:

- OpenAI completes its transition, removing the 100x cap.

- Half of Microsoft’s 2021 and 2023 investments were dilutive, with valuations of $14B in 2021 and $29B in 2023 (as suggested here).

Beyond Microsoft, OpenAI raised a $300M round in 2023 at ~$29B (Series B) and a $6.6B round in 2024 at $157B (Series C). Just yesterday, WSJ reported that OpenAI is in talks for a $40B round at a whopping $300B valuation (Series D). If this round closes as reported, Series A investors will be diluted from 5% to 3.2%, as shown in the table below.

At a $300B valuation, that 3.2% stake is now worth $9.5B – a 189x return on their initial $50M. Not bad!

OLIPOP’s returns

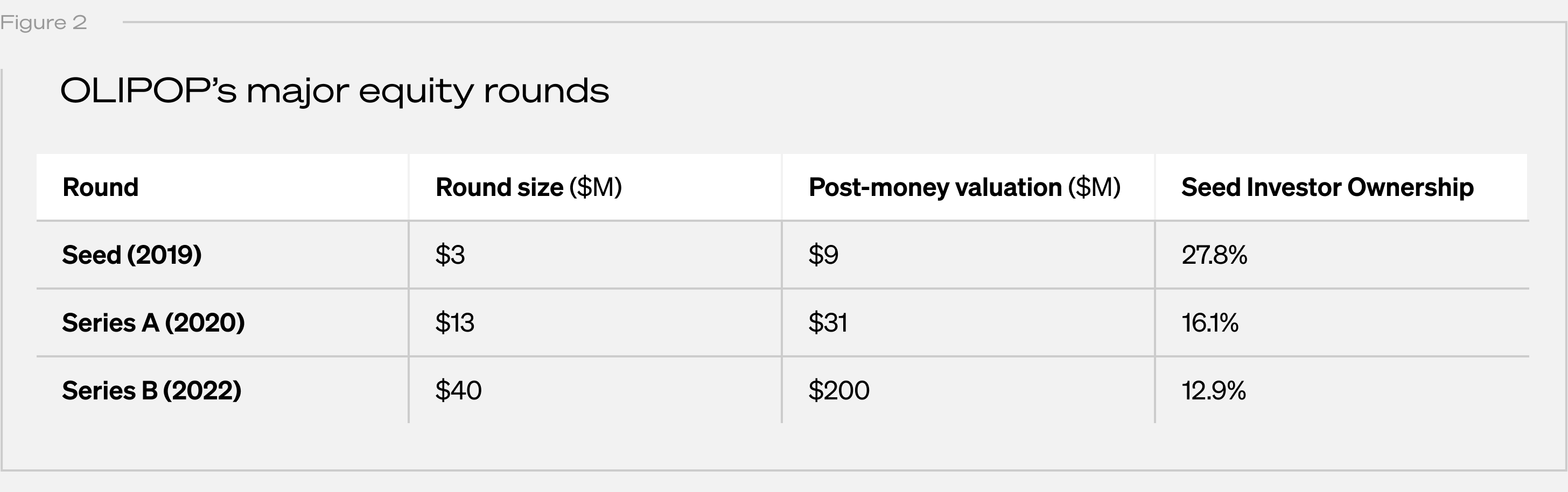

OLIPOP’s story is far more straightforward. PitchBook shows its major funding rounds below:

OLIPOP’s seed investors have been diluted from an initial 28% ownership to roughly 13% today. The last disclosed valuation was during its 2022 Series B, but OLIPOP has grown significantly since then. To estimate its current valuation, we apply a forward revenue multiple from a public comparable to its projected next-twelve-months (NTM) revenue.

OLIPOP’s revenue growth has been remarkable, with several sources indicating it was on track for $500M in 2024 sales, up from $200M in 2023, and $73.4M in 2022. Extrapolating this 2022-2024 CAGR, we estimate NTM revenue of $1.3B. This projection seems reasonable, as revenue growth has shown little sign of slowing, and OLIPOP has significant room to expand distribution and retail presence.

Celsius Holdings (CELH), the maker of CELSIUS energy drinks, offers one of the only relevant public comparables. Applying their 3.8x forward revenue multiple to OLIPOP’s estimated NTM revenue yields an implied valuation of $5.0B.

At this valuation, seed investors’ 13% stake would be worth $639M – an astonishing 256x return on their $2.5M investment, outperforming even the 189x return estimated for OpenAI’s Series A investors.

Future dilution

While current valuations provide a snapshot, returns are realized at the point of liquidity. OLIPOP not only appears likely to deliver higher returns than OpenAI based on current valuations, but is also likely to experience less dilution – and the resulting erosion of returns multiples – before exit. To assess dilution risk, we must evaluate how much additional capital each will need to reach self-sufficiency, where revenues consistently cover operating and capital expenses. Ultimately, this hinges on the strength of each company’s unit economics.

OpenAI’s unit economics

OpenAI’s two primary revenue streams — ChatGPT subscriptions and API usage — present distinct unit economic profiles and associated challenges.

ChatGPT Subscriptions

OpenAI offers several subscription tiers, from a free plan with limited features to a $200/month “Pro” plan. While paid tiers generate predictable monthly revenue, inference compute costs scale with user activity, which can be unpredictable. This means new users don’t always equate to profit growth. This challenge is exemplified by recent reports that OpenAI is losing money on GPT Pro users due to unexpectedly high inference costs, despite the $200/month price point, which Altman set with profitability in mind.

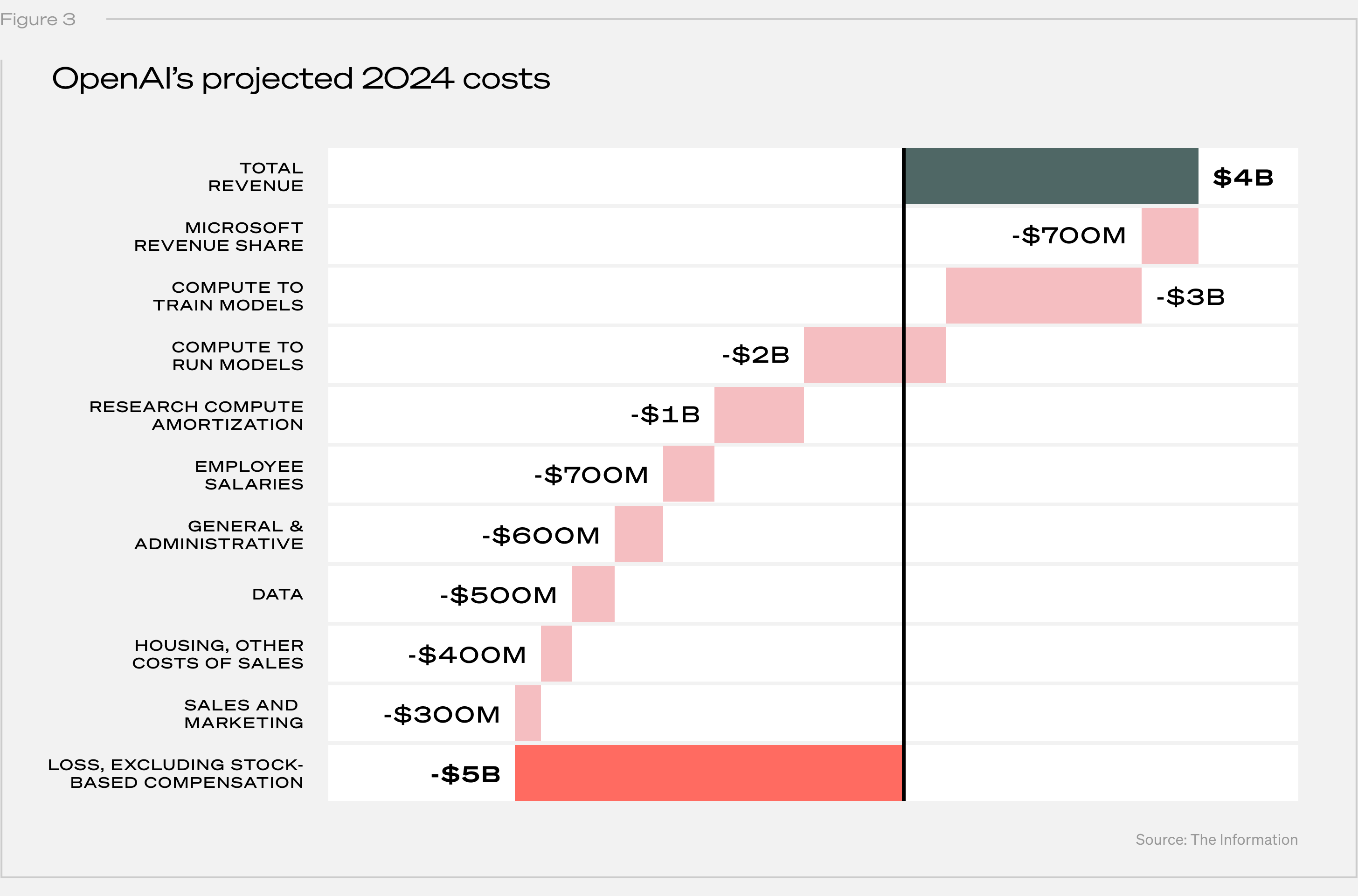

This issue is further exacerbated by the overwhelming proportion of free-tier users – estimated at 95% – who incur inference costs without generating revenue. As a result, paying users effectively subsidize these expenses. Inference compute costs for 2024 were projected at $2B, compared to an estimated $4B in total revenue.

API Usage

The API’s pay-per-token model better aligns revenue with costs, but rising competition has eroded OpenAI’s pricing power. Token prices have plunged 89% in just 17 months, dropping from $36 per million tokens at GPT-4’s launch in March 2023 to $4 by August 2024. DeepSeek, which recently demonstrated that training and inference can be far less compute-intensive, has only accelerated this price collapse. Its reasoning and chat models are currently priced over 95% lower than OpenAI’s.

Training, while not directly tied to unit economics since it doesn’t scale with usage, remains a significant and growing financial burden. Costs are projected to reach $9.5B annually by 2026, with R&D expenses climbing from $1B in 2024 to over $5B in 2026. Though these projections predate DeepSeek’s breakthroughs in cost-efficient training, training will undoubtedly remain a massive and essential expense for sustaining AI leadership.

The following chart illustrates how high inference and training costs, a large base of free-tier users, and pricing pressures combine to create significant profitability challenges.

Training compute costs for 2024 were projected at $3B, with inference costs adding another $2B. Combined with Microsoft’s $700M revenue share and substantial operational expenses, these factors contribute to an estimated $5B loss for 2024, excluding stock-based compensation. These losses are expected to continue, with OpenAI projecting $44B in cumulative losses from 2023 to 2028. Profitability is targeted by 2029, with a revenue goal of $100B.

Covering these massive losses has required successive capital raises, most recently the $40B round, further diluting investors. If OpenAI’s $44B in projected losses through 2028 proves accurate, this latest capital infusion would have brought it close to self-sufficiency. However, a substantial portion of this round is reportedly allocated to OpenAI’s $19B commitment to President Trump’s $500B Stargate initiative, leaving a funding gap. As a result, more funding rounds and investor dilution are likely.

OLIPOP’s unit economics

OLIPOP benefits from straightforward unit economics, driven by predictable production and distribution costs in the established soda industry. Key variable costs include raw ingredients, packaging, co-packing fees, and freight, while fixed costs cover overhead, staff, brand marketing, and R&D. Unlike OpenAI, OLIPOP doesn’t require massive upfront capital or speculative R&D. Its differentiated formulation, brand identity, and consumer positioning also help shield it from commoditization risks despite competition from peers like POPPI.

Regarding future dilution, OLIPOP is already fully profitable. While the company is likely to raise additional capital to accelerate growth, they don’t need to. This gives a more flexible path to exit – OLIPOP could sell to a strategic buyer or IPO without the pressure of hitting complex, multi-year milestones. Fewer funding rounds, less dilution, and a profitable business model mean early OLIPOP investors are far less exposed to the risk of a delayed exit and ownership erosion over time.

Final thoughts

These returns underscore an important lesson: less flashy businesses can sometimes outperform even the most hyped tech companies. This is largely driven by the importance of entry price – achieving a 256x return is far more feasible from a $2.5M starting valuation than from $1B – as well as the path to profitability and the unit economics that pave the way.

While OpenAI is revolutionizing industries, OLIPOP is quietly dominating its category, proving that exceptional returns don’t always come from the highest-profile companies. For investors, the takeaway is clear – entry price and timing are critical, but so is recognizing opportunity in unexpected places.

Finally, full disclosure – Collaborative Fund is a Seed investor in OLIPOP – an investment made before I joined the team. Credit goes to my colleagues for identifying the opportunity early, and even more to the OLIPOP team for consistently exceeding expectations.

If this has left you craving OLIPOP or curious to learn more, you can check them out here. My favorite flavor is Vintage Cola.

A day after the September 11th terrorist attacks, every member of Congress stood on the steps of the U.S. Capitol and sang God Bless America.

Could you imagine that happening today? It’s easy to say no, given how nasty politics has become. But if America faced an existential crisis like 9/11 again, I think you’d see the same kind of unity return. There’s a long history of enemies putting their differences aside when facing a big, devastating threat. People get serious when shit gets real.

If that sounds like wishful thinking to you, let me propose a reason why: Part of the reason today’s world is so petty and angry is because life is currently pretty good for a lot of people.

There are no domestic wars.

Unemployment is low.

Household wealth is at an all-time high.

Innovation is astounding.

It’s far from perfect, and even an optimist could list hundreds of problems and injustices. A pessimist could do worse.

But let me put it this way: As the world improves, our threshold for complaining drops.

In the absence of big problems, people shift their worries to smaller ones. In the absence of small problems, they focus on petty or even imaginary ones.

Most people – and definitely society as a whole – seem to have a minimum level of stress. They will never be fully at ease because after solving every problem the gaze of their anxiety shifts to the next problem, no matter how trivial it is relative to previous ones.

Free from stressing about where their next meal will come from, worry shifts to, say, a politician being rude. Relieved of the trauma of war, stress shifts to whether someone’s language is offensive, or whether the stock market is overvalued.

Imagine a fictional society that has unlimited wealth, unlimited health, and permanent peace. Would they be overflowing with joy? Probably not. I think their defining characteristic would be how trivial and absurd their grievances would be. They’d be enraged that their maid was 10 minutes late, stressed about whether their lawn was green enough, or despondent that their child didn’t get into Harvard.

Psychologist Nick Haslam once described what he called Concept Creep. It’s when the definition of a problem expands beyond its original boundaries. It often gives the impression that the world is getting worse when what’s changed is our definition of what counts as a problem. It happens two ways: